Protect Your Financial Future

Legacy Estate Planning Group, Inc.

& Legacy Wealth Strategies, L.L.C.

Striving to grow and preserve generational wealth while building legacies for

individuals, families, pre retirees and Seniors throughout Nebraska.

At Legacy Estate Planning Group, Inc. & Legacy Wealth Strategies, L.L.C., our goal is to be our clients’ trusted advisor and to be able to handle all aspects of the estate and financial planning process from start to finish. As true legacy planners, and a comprehensive wealth management firm, we concentrate in estate, business and retirement planning for baby boomers, seniors and retirees. We understand that our clients’ most important financial and estate planning goals are to make certain that their wishes are followed with the least amount of turmoil, outside involvement and taxes.

Assets & Risk

We pride ourselves on providing retirement strategies to %%CITY, STATE%% and the surrounding communities. We take a look at your unique mix of assets and integrate those aspects into a coordinated retirement income plan.

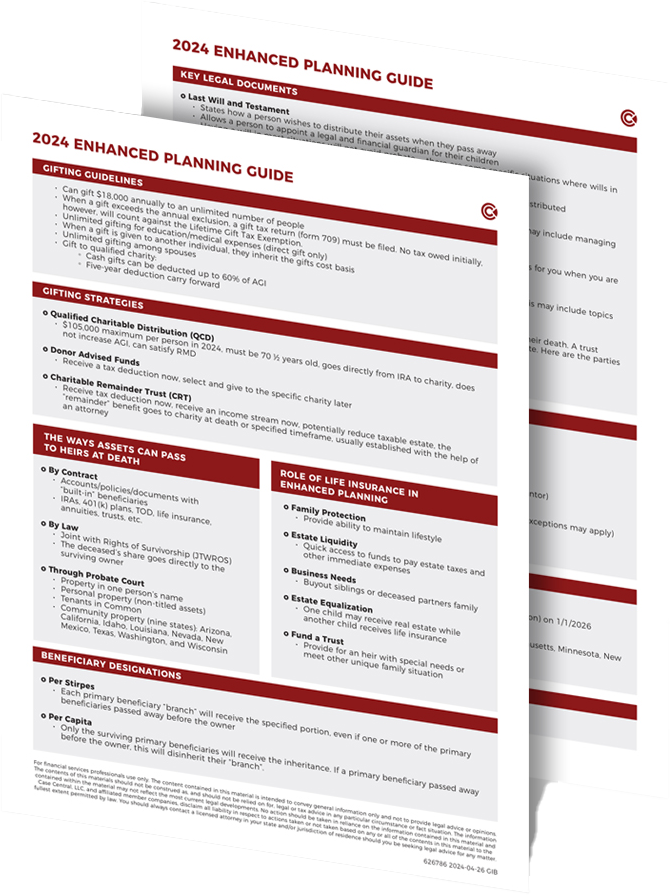

Enhanced Planning

Whether your priorities are preserving assets for future use or transferring your wealth to beneficiaries, we can help you build a plan that fits your needs and maintains family harmony after you’re gone.

Income Planning

Income planning for retirement can be a daunting task for many retirees. At %%COMPANY NAME%%, we are here to help you navigate throughout phases and to help you make sense of the tax advantaged vehicles used to accomplish your goals.

Insurance Solutions

Depending on your unique retirement goals, one of our insurance solutions may strike the right balance between risk aversion and reliable income.

Tax Strategies

One part of building your retirement is determining your tax liability and developing a strategy to help minimize how much you pay. We recommend customizing your retirement to utilize any possible tax credits and deductions.

Generational Vault

Generational Vault never sleeps; it’s your 24-7-365 access to your accounts and important documents all in one place! Reach out to us today to discuss how Generational Vault can help you organize and safeguard the most important documents in your life.

Leave a Legacy of Family Harmony

Request Your Enhanced Planning Guide

Color of Money Risk Analysis

The Color of Money Risk Analysis assesses your financial picture and provides a roadmap to your overall risk preferences. The output will be a proprietary Color of Money score. This short, interactive analysis is the first step on the road to retirement.

Request Your Copy

Request Your Copy

Schedule Your Complimentary Meeting

Submit this form and we will contact you to schedule a complimentary, no obligation meeting.